TRYING

Baby Spreadsheets: A Very American Way To Decide When — Or Whether — To Have Kids

For most couples in the U.S., family planning is a money question. Can it be answered with a spreadsheet?

Is there ever a right time to start a family? Becoming a parent these days, writes Rachel Wiseman in the recent book What Are Children For?, can seem “less like a transition and more like throwing yourself off a cliff.” It is clear that people are waiting longer to hurl themselves into the abyss: Since the 1990s, the birth rate for women in their late 30s and early 40s has steadily increased, while declining for women in their teens and 20s.

In an era that combines reliable contraception with access to almost limitless lifestyle choices, deciding to become a parent can feel surreal, abstract, and difficult to imagine consciously making, especially with limited finances. Why leap into the unknown when you don't have to, especially when there are so many other things to do, and you probably can't afford it anyway?

For some, that first step toward the edge of the parenthood cliff is not couples' therapy or a doctor's office but the neat confines of a spreadsheet. Wrangling an overwhelming amount of information — much of it subjective and particular — into soothing rows and columns feels like second nature for people who regularly use Excel at their jobs.

Two of those people are Reagan, 36, and her husband, 40, who live together in Boston and started their baby spreadsheet to help them decide if children were for them. This was partly a financial question, so building out a Google Sheet with a cash flow and retirement savings model based on various assumptions about their future salary levels was an easy next step. Even though the two of them together earn more than $400,000 a year, they wanted to understand how a potential child would affect the trajectory of their lives: their career flexibility, their ability to save for retirement, their charitable giving, their chance at owning an apartment. “It's kind of an absurd reality of the weird economic conditions we live in that, despite [our salaries], I think we still felt we would have to look at the longer term picture to understand what we could actually afford,” Reagan told me.

They are not alone. The cost of raising a child to age 18 in a middle-class home is over $310,000 in the U.S., according to one estimate, an intimidating sum even for high earners like Reagan and her husband. Those with low incomes may not have the same luxury of creating a savings plan and then tucking away discretionary income in order to be able to, say, take time off after a birth or stay home with a sick child, or pay for the medical care, such as in vitro fertilization, that they might need in order to start their families at all.

These would-be parents acknowledge that using such a bureaucratic tool to plan for something as intimate and incalculable as a possible child might seem reductive, but what they learned from them illuminates how difficult it is to start a family today.

The models weren’t supposed to spit out a yes or no answer — having a child, she said with amusement in her voice, is not a decision that will “lend itself to a pro-con list or a cost-benefit analysis in any real way.” But gaming out what their expenses might look like with one kid, or two, helped them clarify what was important to them. They knew they wanted to stay in their diverse, walkable neighborhood, to be able to take a salary cut if the right opportunity to serve in government arose, and to give away some of their earnings to causes that matter to them. “We don't want to lock ourselves in on fixed costs that will be hard for us to sustain given the values we have and the type of life we want,” she said. “It was about understanding what the trade-offs might be, and to build confidence in my ability to navigate them.”

Electronic spreadsheets for personal computers have been around since 1979, when software engineers Dan Bricklin and Bob Frankston created VisiCalc, presumably not with the baby budget use case in mind. It allowed users to change one cell of a spreadsheet and automatically update the rest, which remains its key feature today. Even if one doesn’t use fancy equations or models, just being able to use the “sum” function to tally up numbers can be illuminating, and more satisfying than the back-of-the-envelope math and pros-and-cons list that came before.

Reagan and her husband did decide to have a child, who is now 2. She knows her baby spreadsheet didn’t capture the biggest unknown about parenthood, the part that matters. “There’s such a speculative component to it,” she said. She had heard from other parents how much they loved their kids, but until she experienced it for herself, she said, “I didn't truly understand how much my heart would grow and how much joy he would bring me and how that would feel.”

Reagan wasn't comfortable sharing the Google Sheet she and her husband used to think through these questions, but I found others who were. While these would-be parents acknowledge that using such a bureaucratic tool to plan for something as intimate and incalculable as their possible child might seem reductive or delusional, what they learned by creating them, and how costs and the process of mapping them influenced the planning of their families, illuminates how difficult it is to start a family today in America, and the gnawing anxiety that haunts even those who would seem to be financially secure.

Jennifer

Financial factors “dictated every choice that we made.”

Jennifer’s spreadsheets began in 2015, after she and her husband had been married for a year and were ready to have a child. The first spreadsheet priced out day care options near their home in a small university town in Southeast Virginia. “We quickly realized, as many parents do, that with the day care shortage it became more about which day care we were going to be able to get into, rather than the one we could afford,” she said.

Jennifer had been diagnosed with endometriosis in her 20s, so when their first six months of trying were unsuccessful, she was referred to a fertility specialist. The information she got at that first visit overwhelmed her; that, she says, is when her spreadsheets “really took off.” There was a spreadsheet dedicated to the different treatment options, and the costs of things such as medications, co-pays, procedures not covered by insurance, diagnostic treatments, gas and mileage to appointments, and medical supplies like syringes, alcohol wipes, and a medical waste box.

After a lot of testing, she received the common but frustratingly vague diagnosis of “unexplained infertility.” Because they did not have the $20,000-plus on hand for an IVF cycle, their clinic recommended starting with the less expensive but less effective method of intrauterine insemination (IUI). That's when Jennifer started a spreadsheet looking at adoption costs, which they quickly realized was even less financially feasible than fertility treatments. Jennifer and her husband both work at the university, and together, they now earn roughly $115,000 a year. At that time, though, they were earning well under $100,000, and adoption, with its agency fees, adoption fees, house visits, paperwork, and doctor’s appointments, would cost them between $40,000 and $100,000, anywhere from half to all of their annual income.

Seven unsuccessful IUI rounds later, says Jennifer, “Our funds were depleted, we had nothing to show for everything we had been through, and we didn’t know what to do.”

“The financial cost for us to be able to have a child dictated every choice that we made, from when to start trying to conceive, to which clinic to use, which treatments to try, the timing of our treatments, even down to the number of children we have.”

Jennifer started researching charities offering grants for fertility treatments, creating yet another spreadsheet. They applied to Baby Quest, one that doesn’t restrict its grant-making to specific demographic groups, such as members of a certain religion, and welcomes all types of families. The $6,000 grant they received covered half of the IVF procedure; another spreadsheet helped them figure out what budget items they could cut to save up the other $6,000. When, unfortunately, the IVF cycle with Jennifer’s eggs didn’t work, she geared up another spreadsheet to price out the cost of a cycle using a donated embryo: registration costs, website fees for donor-recipient matching programs, and medical costs, including the transfer of the embryo to her uterus.

In the end, none of the matches worked out. “We decided to take a break from it all for a couple of months because we were so emotionally and financially exhausted,” she said.

But after several months, she found herself ready to take a fresh look at donor eggs, which she had originally opposed. She and her husband decided to cut even more from their budgets and Airbnb their home on football weekends to come up with donor agency fees on top of IVF — $17,000 in total. “I realized I wanted a baby and did not care who the biological parent was,” she said. “At the end of the day it would still be my child.” The result was their son, who was born in April 2019.

Although she and her husband hoped for two or three kids, “the cost to do it all again is overwhelming enough that we did not try for another child again, and that’s not counting the mental and physical load,” she said.

“The financial cost for us to be able to have a child dictated every choice that we made, from when to start trying to conceive, to which clinic to use, which treatments to try, the timing of our treatments, even down to the number of children we have,” Jennifer said.

Marissa

An “insurmountable number.”

Marissa and her husband have been married for a year, and only recently began thinking about having a child together, following an extended honeymoon during which they traveled and worked remotely from Europe all last summer, which they were able to do because they had moved out of their apartment. Now back in Chicago, where they both work in marketing and have a combined household income of a little less than $10,000 a month, they are starting to envision a future with children.

She and Steve have always had a transparent and open dialogue about their finances, which they’ve essentially merged since getting married. They have a weekly evening meeting, “Wealth Wednesdays,” during which they check in on their finances, sometimes with a bottle of wine. One night, after Steve got up to clear the table, she started putting together a spreadsheet to start their plan to grow their family.

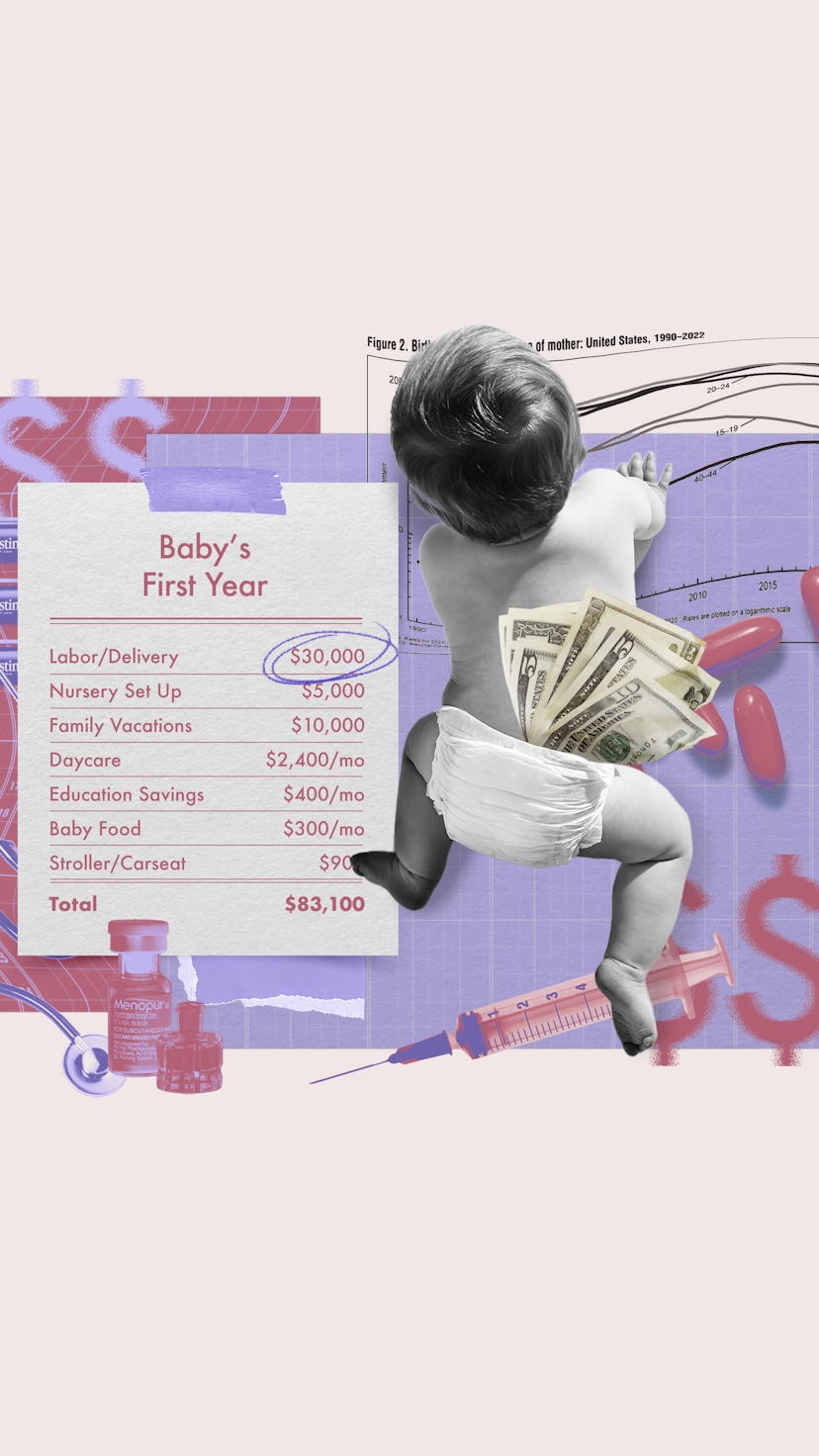

But when Marissa started researching how much it would cost for some of the basics, all she found was blank budget templates, with none of the information she was actually seeking. “You could download or buy these budgets, but all of them were templates, and they didn't actually include numbers,” she said. “I was like, No, I want to know how much it costs me a year to have a kid in 2024, or 2025, or ‘26. What's the line item for formula? What's the line item for a strong contribution to a future education savings account? How much does it actually cost to buy all new maternity clothes?” She was able to find some information herself online, such as the average labor and delivery bill in her area ($30,000). She could identify items she thought she might need, like a baby monitor with a camera that costs $400, and estimate an all-in cost for setting up a nursery ($5,000). She erred on overpricing things, while knowing that she and Steve are resourceful people who enjoy thrifting and finding things on Facebook Marketplace. For other questions, she turned to friends with kids who told her how much they spent on day care in their area (about $2,400 a month for full-time care).

The process of putting everything down in one place was both scary and, strangely, reassuring: It put a destination on a map that had previously been a bit hazy.

They haven’t yet started saving specifically for their future family — they haven’t all of a sudden opened a “Baby Savings Account” yet, she said — but Marissa said the exercise has already affected her behavior. Now when she’s at Target or Marshall’s picking up things she needs, “I’m not going to willy-nilly just grab a few more things and then all of a sudden, my total is $100,” she said.

There’s still a large gap between where they would like to be, now that they have a sense of the numbers, and where they are, savings-wise. The process of putting everything down in one place was both scary and, strangely, reassuring: It put a destination on a map that had previously been a bit hazy. “I'm having a hard time wrapping my mind around the insurmountable number that it will cost to build and have the family and life that we want,” Marissa said. “I recognize that I can't look at it as impossible, because the ROI of building a family isn't more cash – the joy and the love is priceless.” On the other hand, she said, “Seeing it all out there makes it feel tangible versus this sort of untouchable reality.”

She also reminds herself that even though her parents’ generation had some things easier, such as affording a home, people from all kinds of backgrounds can and do have kids. “In those moments when I feel like, Oh my god, are we going to be able to do this? I'm reminded that people are doing this every single day, and family is so important to us.”

Talia

The obstacles are “always financial first.”

The kid question came up for Talia and her partner the first time they kissed. Her partner is a trans woman, and happened to mention that she had frozen her gametes before starting the gender affirmation process. “I remember being like, OK, this is a viable option, because that's the same thing I want,” she recalled. She had previously dated cis men, who rarely brought up the possibility of kids. “Every guy I had been dating had been so wishy-washy about it,” she said.

Talia and her partner are both creatives with day jobs, living in Oakland. Talia is a novelist and short story writer who leads grant-making at a large nonprofit, and her partner is a photographer who runs a small production company that creates videos for clients. While Talia’s income is consistent, her partner’s is less so, and had almost gone to zero when Covid hit and they were pondering their potential family.

Talia created the spreadsheet in the summer of 2020, estimating costs based on what she could figure out from her health insurer and information she found online. She budgeted $1,500 a month for 30 hours a week of child care, either a nanny share or day care, and $75 for disposable diapers, since most day cares, she learned, won’t accept reusable cloth diapers. One cycle of IUI, using her partner’s banked genetic material, would cost $1,216.40, including bloodwork, doctor’s visits, ovulation predictor kits, and the insemination itself.

“I still feel like I'm so far behind, like it's not going to be enough.”

That was manageable, since Talia, then 38, had been saving up for egg freezing since 2018. Over two years, Talia eventually saved around $15,000 in a “Kids are Awesome” account at Ellevest, an investment platform aimed at women, but by that point, a fertility doctor she saw thought she would need at least two rounds of egg freezing to get a decent haul of eggs, which was financially out of reach. It was the most savings she’d ever had, she said, but at the same time, “I still feel like I'm so far behind, like it's not going to be enough,” she told me. It also wasn’t clear where they would get the $1,875 per month or $22,500 a year, that child care and other expenses would cost, not to mention the estimated additional one-time costs of $1,212, which was a conservative estimate, assuming they’d get a stroller and a crib used from Craigslist.

They decided to ignore the numbers and try anyway, moving ahead on an IUI cycle with a queer-friendly midwife in the fall of 2020. But after an examination in October revealed she had a blocked tube, their options narrowed. Not only did a blocked tube lower their chances of getting pregnant, but it also put Talia at risk for an ectopic pregnancy, a condition that can be life-threatening for the pregnant person. Their best option was IVF, which would have consumed all of Talia’s savings just for one cycle. The figures on the spreadsheet went from daunting to simply unfeasible. Talia created a spreadsheet with lists of fertility charities similar to the ones Jennifer identified, “and then I never looked at it again,” she said.

She spent most of the following weeks crying, mourning their chance to have a family, reflecting on the different challenges they’d faced, from not having enough money to freeze her eggs when she was younger, to the cost of IVF. “Every time it's been a different obstacle, but similar in the sense that it's always financial first,” Talia said.

Anna Louie Sussman is a 2024 Alicia Patterson Fellow and Omidyar Network Reporter in Residence. This story was also supported by the journalism nonprofit the Economic Hardship Reporting Project.